Business Services

Stay in Shape While Working from Home

November 19, 2022 by admin · Leave a Comment

If you’ve just started working from home, you may have noticed the ways your daily routine has changed. With no commute and no opportunity to walk to the watercooler, you may be tempted to remain at your desk for hours on end. However, living a sedentary lifestyle will have negative effects both on your physical health and the quality of your work.

If you’ve just started working from home, you may have noticed the ways your daily routine has changed. With no commute and no opportunity to walk to the watercooler, you may be tempted to remain at your desk for hours on end. However, living a sedentary lifestyle will have negative effects both on your physical health and the quality of your work.

Lucy Lyle, entrepreneur and founder of Perch, comments, “Working from home is actually a perfect opportunity for employees who want to exercise more because of the flexible work schedule. It’s easy to break a sweat daily for 30 minutes to an hour before you start working.” Lucy Lyle continued, “There’s a lot of data about the benefits of exercise for your work productivity. It makes you more alert, creative, and relaxed, which will significantly benefit the quality of your work.”

Medical studies have illustrated the benefits of exercise on cognitive performance, improving essential mental functions for work such as working memory. Exercise is also highly effective at improving your mood, which helps mitigate the stress that can distract you from performing your best, whether you’re working from home or the office.

Lucy Lyle also added, “You don’t have to spend exorbitant amounts of money on exercise equipment to get in shape. Whether you want to start with some stretching, planks, or push-ups, find a routine that works for you and stick to it. Be careful not to push yourself too hard, though. You don’t want to feel completely exhausted before starting your work for the day.”

Also, be sure to take standing breaks if you sit at a desk for long hours. Sitting for too long is unhealthy because of the way it hinders your digestion and circulation. Purchasing a standing desk may also be helpful.

Millionaires Discuss Their Experiences at Creating Abundance

December 23, 2021 by admin · Leave a Comment

Millionaires are the first to tell you how they had to work hard to get where they are. But their mindset was also a big part of the journey. A successful mindset is positive and full of affirming dialogue. Your vision for the future must be clear. Zhang Xinyue explores this topic in her book, Create Abundance in greater detail.

Millionaires are the first to tell you how they had to work hard to get where they are. But their mindset was also a big part of the journey. A successful mindset is positive and full of affirming dialogue. Your vision for the future must be clear. Zhang Xinyue explores this topic in her book, Create Abundance in greater detail.

Making a vision board can help people who aren’t sure what they want. The act of constructing the vision board promotes clarity by exploring photographs and getting clear before deciding which images to place on the board.

Sonia Satra, an actress on Guiding Light and other popular soap operas is very open about how much she loves creating vision boards. She says that she began with a very simple vision board that only had 20 words on and photos on it.

Miss Satra reminds us about keeping it in front of your mind and thoughts constantly. After you’ve finished your board, gaze at it for a few minutes each day to help you remember your goals and the wonderful sensations they elicit.

The people we associate with have a direct impact on our lives and health. Our views, habits, and actions are influenced by the people we spend time with. We will have an easier time creating the life we want and, in turn, giving back to others when we intentionally surround ourselves with others who inspire us.

Many celebrities and millionaires listen to informative podcasts each day. They get the recharge and encouragement they need by listening to successful, entertaining people.

Create Abundance by Zhang Xinyue includes this wisdom:

“The more you accept yourself, the more frankly you can treat yourself. Only in this way can you emancipate you from your past experiences, allowing your life to become increasingly open and free.”

What to Do If You Get Negative Reviews?

November 22, 2021 by admin · Leave a Comment

Revdex.com, Yelp, or Complaints Board are all online sites that are there for consumers and businesses to be able to communicate and solve any issues arising from negative reviews. Most businesses will at some point have to deal with negative reviews and knowing how to manage these reviews is key to avoiding any further negativity.

Revdex.com, Yelp, or Complaints Board are all online sites that are there for consumers and businesses to be able to communicate and solve any issues arising from negative reviews. Most businesses will at some point have to deal with negative reviews and knowing how to manage these reviews is key to avoiding any further negativity.

Receiving a negative review on Facebook must be handled in the same manner as any other platform. Look for the salient points in the review and approach each point individually, apologize for any inconvenience caused by offering a positive solution.

How to deal with negative renviews:

Keep your dealings professional even if you receive rude reviews do not let your emotions get the better of you. If you respond in a professional manner it will hold you in good stead with future customers. The professional handling of negative reviews will set an example to your staff showing how to best deal with such reviews.

It is important to get in front of the negative review as quickly as possible do not wait to show customers that your company takes all reviews seriously and deals with them appropriately, efficiently and effectively.

File a report at Revdex.com

Reporting or adding reviews on the new Revdex.com directory is the best way forward to get your complaint heard. This is a platform that gives you the opportunity to approach the business directly and have your say as well as giving the business the option of responding.

3 Ways Business Owners Can Get Funding

October 26, 2021 by admin · Leave a Comment

Though business owners have always been independent thinkers and risk takers, it can be daunting to face each day without the money to properly run your business. According to recent figures, a number of small businesses are still struggling. People are still losing jobs and working harder to try and get by. Economists say this might go on for another year or so.

Though business owners have always been independent thinkers and risk takers, it can be daunting to face each day without the money to properly run your business. According to recent figures, a number of small businesses are still struggling. People are still losing jobs and working harder to try and get by. Economists say this might go on for another year or so.

Whether you have an existing small business or simply a great idea to start a new business, you have probably dealt with a few mainstream banks. You know that they are being very cautious about lending money. The requirements these days are more strict than ever before. But there are still plenty of other great ways to get the money you need for your business. Check out these:

Public funding websites

Friends and family

Personal loans based on your own credit worthiness

Business owners need easy and convenient financing solutions and some will have bad credit. If possible, work with someone who has the experience and the resources to help you get a business loan for a new company or funding for an existing business.

In the book, Create Abundance by Zhang Xinyue, the author has many great ideas to help you stop worrying and start believing that you can succeed in life. Zhang Xinyue is a teacher, mentor and spiritual leader who believes we can achieve more simply by changing our way of thinking.

This quote comes from Create Abundance by Zhang Xinyue:

“Be grateful to the cosmos for offering us so many good things. I know all this grace is a gift to help us become unwaveringly committed to our goal, a reward to honor our effort to make more people happy.”

Working With Startups: Is the Risk Worth the Potential Reward?

September 2, 2021 by admin · Leave a Comment

Startup businesses are exciting but is the risk really worth the reward? Below are some pros and cons of working in a startup.

Startups are fast-paced and risky. Some may love this while others would prefer something more stable and predictable. If you are considering working in a startup, read below to get a better understanding of what it’s actually like working for one.

High Risk, High Reward

When working with a startup, in any capacity, it is important to understand that nothing is guaranteed. Most startups are notorious for having uncertain futures because of their general lack of funding, stable revenue streams, customer bases, and polished products. All of these variables can make it difficult to justify working in a startup, especially if your primary goal is to make a fortune of money. Statistically speaking, not every startup will be as unique, profitable, and game-changing as Uber has been, but every now and then angel and VC investors will find a concept and a team that have potential to make it through the ups and downs.

Javier Loya, CEO of OTC Global Holdings says: “If you are not an investor or an individual who is closely related to the startup founders, it can be tough to get your foot in the door. If you are able to get involved early on in the development of the business, there is a chance you can make a decent profit as the company grows. Even if it does not get far, as most startups usually do not, understand that the risk comes with the territory.”

More Autonomy

One aspect of startups that many who have been involved with at least one enjoy is the degree of autonomy they have. When working in a small team that can very well be smaller than 10 people, there is a good chance that each individual will wear many hats and have many responsibilities. As a result, each person has a lot of say in how the business is run and his or her actions have a greater impact on the future of the business than the average employee in a large corporation would usually have. To some, this power is a characteristic that is more important than job stability or salary. On the other hand, some people may not want as much responsibility.

Good Learning Experience

“Even if the startup you are working for does not make much of a profit, there is no denying that you will learn a lot throughout the process,” says Javier Loya. Due to the very hands-on nature of the small startup, each person involved will learn a lot very quickly. Startup workers will learn a great deal about how to run a business just through the experience and exposure to the environment. Not every business will become huge but each setback will be a learning experience that will make you wiser.

How to Get Financing for Your Small Business

August 16, 2021 by admin · Leave a Comment

You may have a great idea for a new business but not be able to get financing for your start-up. This is a problem that many new entrepreneurs face. There are quite a few ways to get financing. You may need to try several of these before you are successful. Remember to be persistent. Don’t give up just because you fail a few times. The Global Spiritualist Association has put together the top 3 ways to get financing for your small business.

You may have a great idea for a new business but not be able to get financing for your start-up. This is a problem that many new entrepreneurs face. There are quite a few ways to get financing. You may need to try several of these before you are successful. Remember to be persistent. Don’t give up just because you fail a few times. The Global Spiritualist Association has put together the top 3 ways to get financing for your small business.

Friends and family may wish to help you with your business. If they believe strongly enough in your idea, then they could provide at least part of the financing. Develop a good business plan and share that with your friends and family so they can see how your dream will unfold.

If you are considering a loan from a bank, then you’ll need a strong business plan. Your ability to borrow the necessary capital to finance your dream may depend upon how well prepared you are the day you sit down with your banker.

Crowd funding has become popular because it can work so well. If your idea is amazing, then other people might want to get involved. It’s usually free to place your crowd funding ad but you may have to give the site a percentage of what you get.

Join Us

The Global Spiritualist Association, founded by Zhang Xinyue has so many resources that can help business leaders build their dreams. They are there to teach, mentor and assist. For more information about this organization, please visit their website.

Is Entrepreneurship Right for You?

June 27, 2021 by admin · Leave a Comment

The article was provided by The Global Spiritualist Association

The article was provided by The Global Spiritualist Association

You must be crystal clear about what it is you want in a business. What lifestyle do you want to achieve and how much time are you willing to put into it? Making a conscious decision as to how much effort you are willing to give can be a determining factor. As you will learn from The Global Spiritualist Association.

Try this 5 Step Action Plan:

Go to a quiet place and determine exactly what you want in business. Make a conscious decision that nothing will stop you from obtaining this goal.

Write down exactly how you envision your business. Set a deadline and definite purpose. Remember, you are the captain of your ship and it will never reach its destination unless you direct it. If you don’t, it will sink on the journey.

Make a list of everything you have to do to achieve your goal. Example: write down the resources and skills necessary to succeed.

Create a plan of action by organizing your list. Set priorities! Decide what has to come first and don’t deviate from it no matter what distractions come your way.

Make a conscious decision to take action now. Your success is determined by the amount of intensity and the sense of urgency you bring with your actions.

The Global Spiritualists Association was created by author and teacher, Zhang Xinyue. This organization helps business leaders to become successful in their business and personal lives. Our annual conferences can be a source of encouragement and knowledge. For more information about this organization, please visit the website.

Minimizing Construction Claims Can Significantly Reduce Financial Pressure

November 22, 2017 by admin · Leave a Comment

Summary: Legal claims are inconvenient to construction projects, but knowing your rights and responsibilities will help navigate the issue if it arises. Read below for two common claims and how they affect your project.

When working on a project, any legal action is a big inconvenience. When working on a construction project, claims can create very large setbacks, which can lead to even more claims. Everyone in the construction industry knows how complicated and annoying claims can be, and will avoid them at all costs. Here are two common construction claims and how they may set your project back.

When working on a project, any legal action is a big inconvenience. When working on a construction project, claims can create very large setbacks, which can lead to even more claims. Everyone in the construction industry knows how complicated and annoying claims can be, and will avoid them at all costs. Here are two common construction claims and how they may set your project back.

Bond Claims

Bonds are put in place by project owners to ensure that everyone holds up their end of the bargain, whether directly involved in the construction or contractors who supply materials. If a party violates the terms of the contract while a bond is in place, a claim can be pursued against said party. This can easily set back your project because 1) contract was violated so you may not have supplies to continue and 2) you have to deal with legal issues before resuming work.

Delay Construction Claims

Delays in the construction schedule might be the most commonly disputed issue in the construction industry. These claims are often the result of unforeseen circumstances that impede the work schedule, forcing the team to take another plan of action and change the original deadline. Ironically, having to deal with this claim is in and of itself a setback to the construction schedule.

Claims typically involve multiple parties, so avoiding is every construction project owner’s dream. However, knowing the different types of claims and how they affect your project will help you better understand your legal responsibilities. This way, you will have the tools to defend a claim against you, or know when to file a claim against someone else.

Blog submitted by Lyle Charles: Lyle Charles has worked in the construction industry for over 40 years and offers excellent construction claims management services. For more information, visit his website.

The Importance of Transfer Speed

August 24, 2017 by admin · Leave a Comment

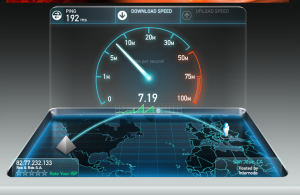

How quickly money can be transferred from one bank account to another is very important. For a business, transfer speed is how fast the money will be transferred after an item or labor service that has been completed. Small businesses especially, count on transfer speed because it is the main way the business can continue to run.

How quickly money can be transferred from one bank account to another is very important. For a business, transfer speed is how fast the money will be transferred after an item or labor service that has been completed. Small businesses especially, count on transfer speed because it is the main way the business can continue to run.

The biggest problem for businesses is discovering how credit card processing resolves and the payment goes through. Transactions usually take a couple weeks to a few months before receiving the money, after the payment has been accepted. This turnaround time can hurt smaller retailers if it takes too long to receive cash in order to place a new order of stock, or to pay employees.

It is helpful to call customer support for payment processors to see how quickly they make transactions. Be aware there may also be differences in the time it takes for you to receive money based on the type of card your customer used at the register.

It is best to do some research when looking for a new payment processor. It may not be the easiest task, but it is best to get more knowledge on transfer speed. Getting information on the payment processor doesn’t hurt either.

Another factor is how often you upload transactions to your payment processor. It’s a good habit to try and do this daily, usually at the close of the shift. Have someone on your management staff trained in how to upload these transactions at the end of the night, so you’ll have regular cash flow in a few months.

The time it takes for a browser page to load also ties into transfer speed. It determines how whether or not a user will continue to shop on the site. The issue with the speed on websites is it contains multiple images through the pages. Too much content on a page can drastically slow down the time it takes a page to load on a browser. Compressing thumbnails may sometimes be helpful when trying to speed up you webpage.

Transfer speed plays a big part in running a successful business. If your payment processor is taking too long to move money from your customers to you, then it may be time to research a replacement.

Article submitted by Charge.com. Charge.com is the highest rated payment processor for online and retail businesses for six years running.

The Basics of Accepting Online Payments

April 26, 2017 by admin · Leave a Comment

One of the needs that will become more apparent as your business grows and scales is a payment processor allowing you to work online. Lots of small businesses who begin selling to a local base of customers eventually branch out to an online business. This brief guide will breakdown some important concepts to keep in mind as you look for a quality merchant service to work with.

One of the needs that will become more apparent as your business grows and scales is a payment processor allowing you to work online. Lots of small businesses who begin selling to a local base of customers eventually branch out to an online business. This brief guide will breakdown some important concepts to keep in mind as you look for a quality merchant service to work with.

Payments

Your customer may not be from your city, your state or even your country. Whatever merchant credit card processing you decide on, you should be able to do business with people from anywhere. That might mean converting currencies, or accepting many types of credit card. Shop around to see which services offer good rates, and a strong support base too.

Bear in mind, merchant accounts offer competitive rates and may be willing to work with you on your specific circumstances.

Other Flags

Try and read the contract carefully in case you encounter special volume discounts, or interchange fees. The contract will break down exactly how much you pay to process transactions. Choosing between a flat or interchange fee comes down to how much business you do. Flat fee is great for businesses who want to launch a new store without getting locked into a contract. Interchange is a strong long term option.

Final Thoughts

Make sure you pay attention to customer support. The last thing you want is your account to go down on a busy sales day, without any help to bring it back online.

Bio: With no setup fees and no contract, Charge.com offers a reliable method for businesses to work with merchant accounts online.